The origin of options

Contracts with the concept of options have been around since ancient times. The earliest recorded buyer of options was Thales, a Greek philosopher. Anticipating a bumper harvest next year, he predicted demand for olive presses would outstrip supply and rental prices would soar. So he spent money in advance during the off-season to make a deal with the press owner to rent multiple olive presses for next spring to use. The next spring, the olive harvest was indeed larger than expected, and the press was in short supply. He then subleased the right to use the press at a very high price, making a large profit.

What is an option?

The term option refers to a financial instrument that is based on the value of underlying securities. An options contract offers the buyer the opportunity to buy or sell—depending on the type of contract they hold—the underlying asset. Unlike futures, the holder is not required to buy or sell the asset if they decide against it.

Each options contract will have a specific expiration date by which the holder must exercise their option. The stated price on an option is known as the strike price. Options are typically bought and sold through online or retail brokers.

Options are financial derivatives that give buyers the right, but not the obligation, to buy or sell an underlying asset at an agreed-upon price and date.

These underlying assets include stocks, indexes, bonds, foreign currencies, commodities, and more.

Main Glossary of Options

1. UNDERLYING ASSETS

Underlying assets refer to the trading object agreed upon by the buyer and seller of an option contract, which can be a certain stock, ETF, index, foreign exchange, etc.

2. OPTION TYPES

Call - The right, not the obligation, to buy asset at a specific price. The call buyer owns the right, whereas the call seller has the obligation.

Put - The right, not the obligation, to sell asset at a specific price. The put buyer owns the right, whereas the put seller has the obligation.

3. STRIKE PRICE

The strike price is the price at which the underlying asset is agreed to be bought or sold in advance, regardless of the current price of the underlying asset.

4. EXPIRY DATE

The specified date and time when the options contract ends (or expires). American options can be exercised any time before the expiration date of the option, while European options can only be exercised on the expiration date or the exercise date.

5. PREMIUM

An option premium is the current market price of an option contract. It is thus the income received by the seller of an option contract to another party. In-the-money option premiums are composed of two factors: intrinsic and extrinsic value. Out-of-the-money options premiums consist solely of extrinsic value.

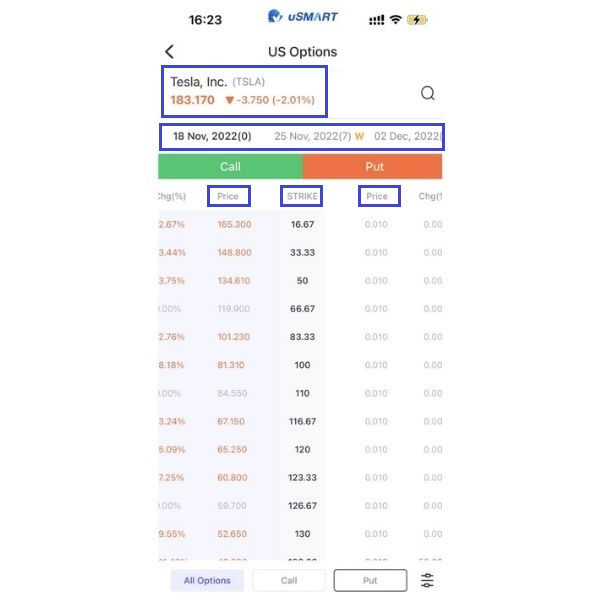

Investors can see these key elements by opening option list of an underlying asset on the uSMART APP.

Understanding Option Pricing

Option pricing can be complicated, as it depends on several key factors. The intrinsic and time values are two key principles of how option premium is derived.

1. Intrinsic Value

Intrinsic value in options pricing is the difference between the strike price and the current asset price. Generally, there are three cases: In the money (ITM), Out of the money (OTM), and At the money (ATM).ITM indicates that the option contract contains intrinsic value.

-

- Intrinsic values of call options=Underlying asset price-Strike price

- Intrinsic value of put options=Strike price-Underlying asset price

|

Scenario |

Call Option |

Put Option |

|

Current price<Strike price |

OTM, Intrinsic value=0 |

ITM, Intrinsic value>0 |

|

Current price>Strike price |

ITM, Intrinsic value>0 |

OTM, Intrinsic value=0 |

|

Current price=Strike price |

ATM, Intrinsic value=0 |

ATM, Intrinsic value=0 |

2. Time Value

Time value in options pricing refers to the contract’s extrinsic value. It’s based on the expected volatility of the underlying asset’s price and the time until the option's expiration date. This means that if the option contract has more time before expiration, it is more likely to be in the money.

As the expiry date draws closer, the time value of the option drops – but this is in a non-linear fashion. This is called time decay, which works against the buyer and favors the seller. Time decay is not fixed. The closer the option is to expiration, the faster the time value will wear out.

3. Common phenomena

|

Factor |

Factor Movement |

Call Option |

Put Option |

|

Underlying Asset |

↑ |

↑ |

↓ |

|

Strike Price |

↑ |

↓ |

↑ |

|

Expiry Date |

↑ |

↑ |

↑ |

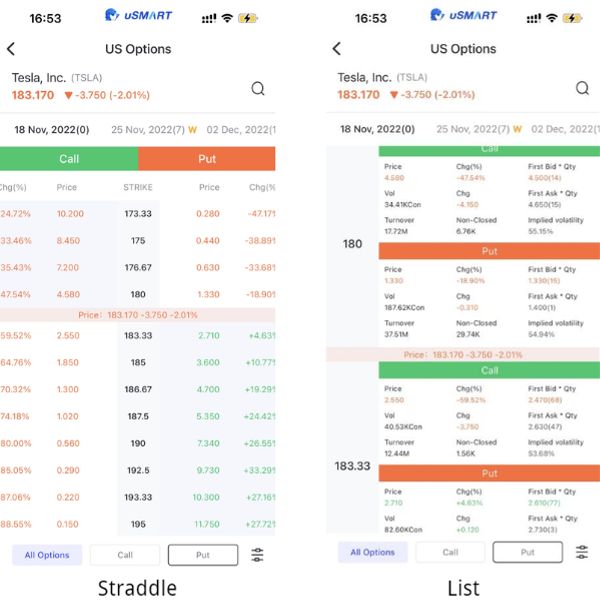

These pricing changes can be viewed through the uSMART option quotation list. In the uSMART APP, there are two settings of option list, namely "Straddle" and "List".

Why Use Options?

1. Directional Trading

Options give investors the chance to make money in different market conditions, whether they are up, down, or in a narrow range. For example, if you think the share price of A will rise, you might consider buying a call option on A. Conversely, if you think its share price will fall, you might buy a put option on A. If you think A will stagnate, you may write a call or put option.

For experienced short-term investors, options are a sharp tool, because you can use options to invest in stock price trends and specific price time while using different conditions to form a variety of composite trading strategies to expand investment opportunities.

2. Hedging

If you own a stock that you think has room to go up, but you also want to limit your losses if it goes down, you can hedge your downside risk by buying a put option.

3. Leverage Effect

Options can provide leverage and improve the efficiency of capital operation. Investors only need to pay a small premium to throw out a minnow to catch a whale. At the same time, the profit of call option is unlimited, but the risk is only limited to the loss of upfront premium.

The Risks of Trading Options

Trading options carry a high risk and are not suitable for all investors. The buyer may choose not to exercise the contract if the price moves unfavorably, but the seller of the option contract is obligated to buy or sell the underlying asset to the buyer. The risk of a Call Option is limited. The biggest risk for the buyer of the option is the loss of the premium. However, the risk of a Put Option is unlimited. There is a chance that the final loss will be greater than the margin, and more money will be needed if necessary. In addition, options may become untradable under certain circumstances, such as in unusually volatile markets, where it may be difficult for you to buy or sell them.

Basic Options Strategies

|

Strategy |

Suitable Scenario |

Risk |

Profit |

|

Long Call |

Price is rising |

Loss premium |

Unlimited |

|

Short Call |

Price is dropping |

Unlimited |

Received premium |

|

Long Put |

Price is dropping |

Loss premium |

Unlimited |

|

Short Put |

Price is rising |

Unlimited |

Received premium |

1. Long Call (buy a call option)

You may purchase the underlying asset at the strike price on or before the expiration. The greater the increase in market prices, the greater your profit will be.

2. Short Call (sell a call option)

As the seller of a call option, if the option is exercised by the buyer at expiration, you must sell the asset at the strike price. The greater the drop in market prices, the greater your profit will be.

3. Long Put (buy a put option)

You may sell the underlying asset at the agreed price on or before the expiration. The greater the drop in market prices, the greater your profit will be.

4. Short Put (sell a put option)

As the seller of a put option, if the option is exercised by the buyer at expiration, you must buy the asset at the strike price. The greater the increase in market prices, the greater your profit.

Disclaimer:This article is intended for general circulation and educational purpose only and does not take into account of the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment products mentioned. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product in question is suitable for you.

Past performance figures as well as any projection or forecast used in this article, are not necessarily indicative of future performance of any investment products. Your investment is subject to investment risk, including loss of income and capital invested. The value of the investment products and the income from them may fall or rise. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this article. Overseas investments carry additional financial, regulatory and legal risks, you should do the necessary checks and research on the investment beforehand.

The information contained in this article has been obtained from public sources which the uSMART Securities (Singapore) Pte Ltd (“uSMART”) has no reason to believe are unreliable and any research, analysis, forecast, projections, expectations and opinion (collectively “Analysis”) contained in this article are based on such information and are expressions of belief only. uSMART has not verified this information and no representation or warranty, express or implied, is made that such information or Analysis is accurate, complete or verified or should be relied upon as such. Any such information or Analysis contained in this presentation is subject to change, and uSMART, its directors, officers or employees shall not have any responsibility for omission from this article and to maintain the information or Analysis made available or to supply any corrections, updates or releases in connection therewith. uSMART, its directors, officers or employees be liable for any or damages which you may suffer or incur as a result of relying upon anything stated or omitted from this article.

Views, opinions, and/or any strategies described in this article may not be suitable for all investors. Assessments, projections, estimates, opinions, views and strategies are subject to change without notice. This article may contain optimistic statements regarding future events or performance of the market and investment products. You should make your own independent assessment of the relevance, accuracy, and adequacy of the information contained in this article. Any reference to or discussion of investment products in this article is purely for illustrative purposes only, is not intended to constitute legal, tax, or investment advice of any investment products, and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products mentioned. This article does not create any legally binding obligations on uSMART. uSMART, its directors, connected persons, officers or employees may from time to time have an interest in the investment products mentioned in this article.

Global

Global Singapore

Singapore Hongkong

Hongkong Group

Group