.jpg)

US Macro Strategy Weekly Report – 13 June 2023

By James Ooi/ uSMART Market Strategist

Over 13 years of experience in buy-side and sell-side of capital markets

Former Fund Manager of renowned asset management firm

Focus on fundamental analysis and macro-outlook for US & Singapore markets

SGX Academy trainer

This Week’s Market Outlook

- This week, significant economic data in the United States includes the release of the May Consumer Price Index (CPI) on Tuesday, the Producer Price Index (PPI) on Wednesday, and the retail sales data on Thursday. The market's main focus is on the interest rate decision and dot plot of the FOMC meeting, which is scheduled for the early hours of Thursday morning.

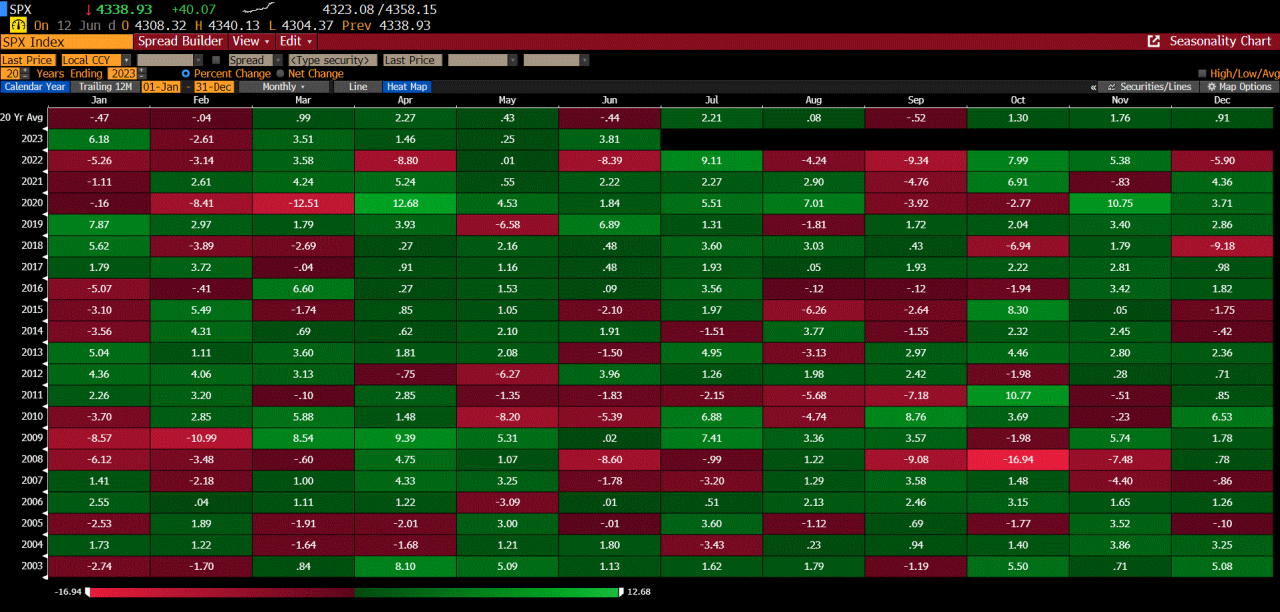

- Over the past 20 years, the S&P 500 index has experienced an average decline of 0.44% in June due to seasonality, with a notable drop of 8.39% in 2022 (Figure 1). However, the S&P 500 index has recorded a month-to-date return of 3.81% thus far this year.

Figure 1: Monthly performance of the S&P 500 over the past 20 years.

Source: Bloomberg, 12 June 2023

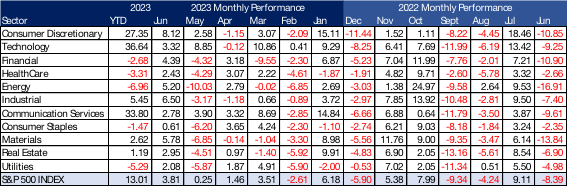

- In June, there was a broad upward trend across all sectors, with notable strength observed in previously underperforming sectors such as energy, industrials, and basic materials, which recorded gains of 5.2%, 6.5%, and 5.78% respectively (Figure 2). If the Federal Open Market Committee (FOMC) unexpectedly decides to raise interest rates on Thursday, it is expected that sectors that have been lagging behind this year, including consumer staples, healthcare, finance, and utilities, will experience a rebound. However, technology-related sectors, which have been benefiting from the expectation of lower rates, may face selling pressure.

Figure 2: Monthly performance of the S&P 500 over the past 20 years.

Source: Bloomberg, 12 June 2023

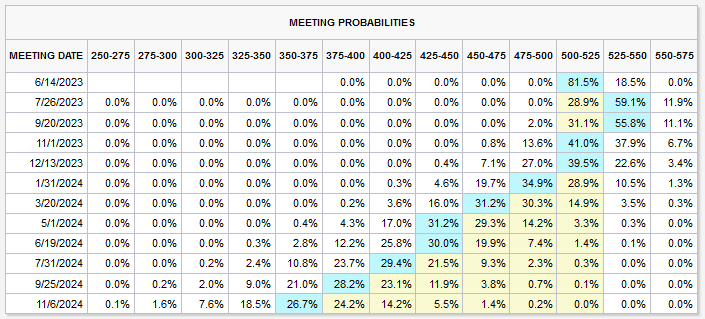

- CME Fedwatch currently indicates a 59.1% probability of a rate hike in July, followed by an expected reduction of 25 basis points during the November FOMC meeting(Figure 3). This would bring the FOMC rate to a range of 5 to 5.25% at the end of year. In the past, technology-related stocks rallied due to the anticipation of rate cuts. However, the equity market has not corrected itself in response to the new narrative of "higher rates for a longer." Market participants may still have confidence in the possibility of further rate cuts by the end of the year, or they could believe that better-than-expected economic growth will drive corporate earnings later this year.

- I am of the opinion that the notions of "maybe AI will save us" and "earnings woes are over" are exaggerated. The improvement in the bottom line of companies is primarily attributed to cost-cutting measures rather than top line revenue growth, which means that the improvement in earnings is superficial.

Figure 3: CME Fedwatch

Source: CME Fedwatch

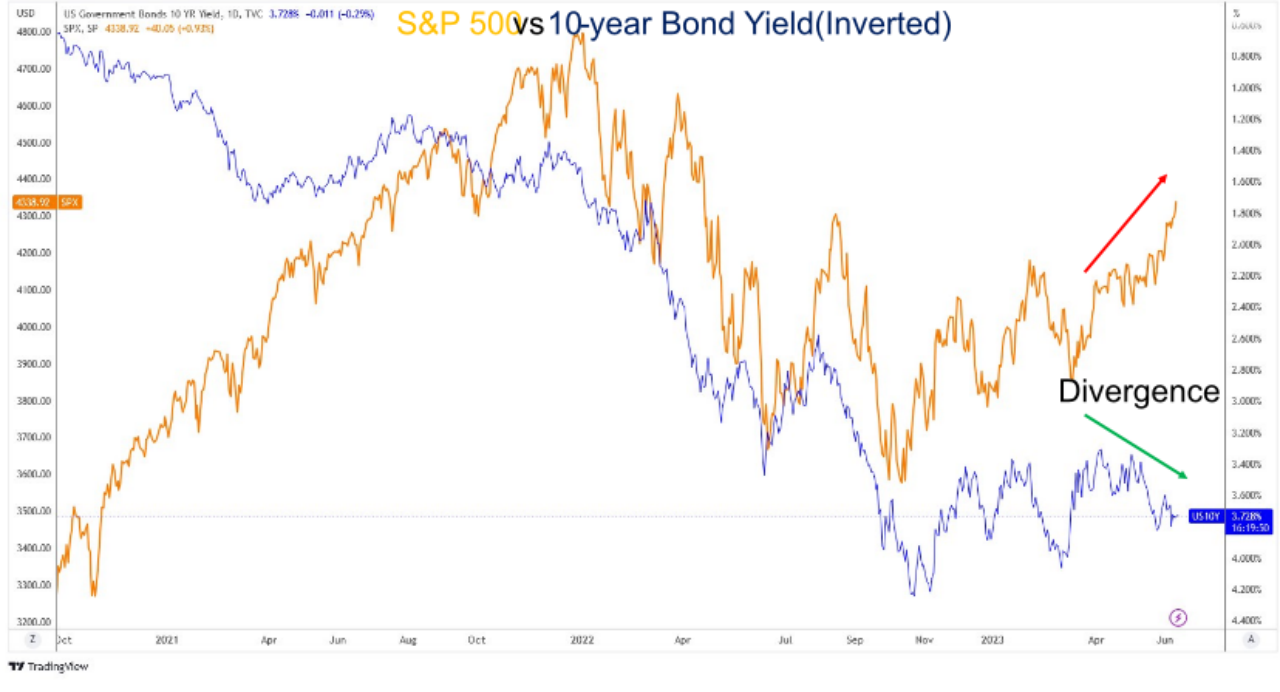

- There is still a divergence between bond yields and the S&P 500 index ahead of the FOMC meeting (Figure 4).

Figure 4: S&P 500 and 10-year bond yield

Source: uSMART, Tradingview

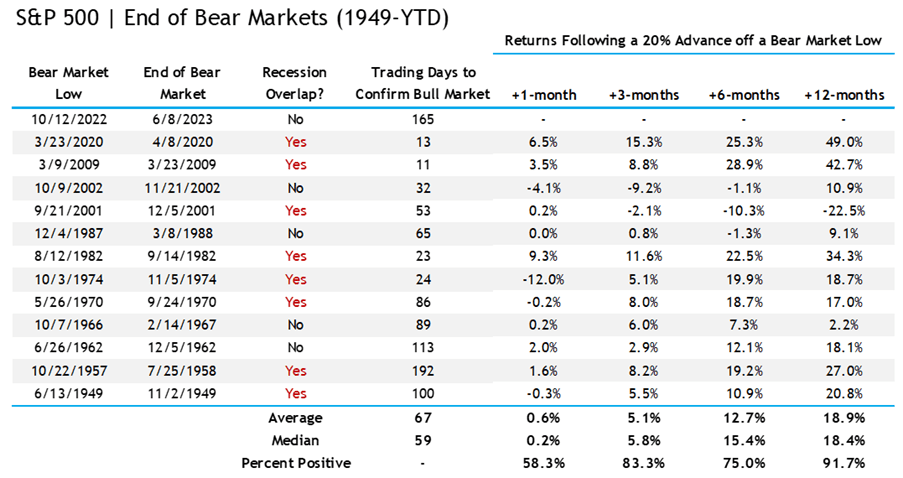

- The S&P 500 index has rebounded more than 20% since its October 2022 bottom(Figure 5). Statistically speaking, there is a 97% probability that the S&P 500 index will continue to climb in the next 12 months, with an average increase of 18.9%.

Figure 5: S&P 500's 12-month forward return following a 20% rebound.

Source: LPL Research

- “The bear market is officially over,” Bank of America's top strategist Savita Subramanian declared in a Friday message to clients. She further revised the year-end target for 2023 from 4,000 points to 4,300 points. However, another strategist at Bank of America, Michael Hartnett, has not capitulated and continues to hold a bearish perspective. He believes that the view of rising earnings forecasts combined with falling rates as “unsustainable.”

- While we continue to hold a short-term bearish view, we would like to emphasize the points we made in our previous weekly notes on April 11th and April 18th. We suggested that investors may want to consider implementing a core-satellite strategy. It is important to note that the cash allocation in the portfolio should not exceed 30% in order to avoid missing out on potential investment opportunities in the event that the market continues to rise.

- Currently, there are several high-quality companies, such as Apple, Amazon, Visa, Tesla, Costco, and Microsoft, that continue to demonstrate strong long-term EPS growth potential. Investors may consider gradually establishing long-term positions in these companies. Additionally, investors can also explore ETFs like SPY, QQQ, and SUSA to capture some market returns.

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimer:

This article is intended for general circulation and educational purpose only and does not take into account of the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment products mentioned. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product in question is suitable for you.

Past performance figures as well as any projection or forecast used in this article, are not necessarily indicative of future performance of any investment products. Your investment is subject to investment risk, including loss of income and capital invested. The value of the investment products and the income from them may fall or rise. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this article. Overseas investments carry additional financial, regulatory and legal risks, you should do the necessary checks and research on the investment beforehand.

The information contained in this article has been obtained from public sources which the uSMART Securities (Singapore) Pte Ltd (“uSMART”) has no reason to believe are unreliable and any research, analysis, forecast, projections, expectations and opinion (collectively “Analysis”) contained in this article are based on such information and are expressions of belief only. uSMART has not verified this information and no representation or warranty, express or implied, is made that such information or Analysis is accurate, complete or verified or should be relied upon as such. Any such information or Analysis contained in this presentation is subject to change, and uSMART, its directors, officers or employees shall not have any responsibility for omission from this article and to maintain the information or Analysis made available or to supply any corrections, updates or releases in connection therewith. uSMART, its directors, officers or employees be liable for any or damages which you may suffer or incur as a result of relying upon anything stated or omitted from this article.

Views, opinions, and/or any strategies described in this article may not be suitable for all investors. Assessments, projections, estimates, opinions, views and strategies are subject to change without notice. This article may contain optimistic statements regarding future events or performance of the market and investment products. You should make your own independent assessment of the relevance, accuracy, and adequacy of the information contained in this article. Any reference to or discussion of investment products in this article is purely for illustrative purposes only, is not intended to constitute legal, tax, or investment advice of any investment products, and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products mentioned. This article does not create any legally binding obligations on uSMART. uSMART, its directors, connected persons, officers or employees may from time to time have an interest in the investment products mentioned in this article.

Global

Global Singapore

Singapore Hongkong

Hongkong Group

Group