.jpg)

US Macro Strategy Weekly Report – 11 July 2023

James Ooi/ uSMART Market Strategist

Over 13 years of experience in buy-side and sell-side of capital markets

Former Fund Manager of renowned asset management firm

Focus on fundamental analysis and macro-outlook for US & Singapore markets

SGX Academy trainer

This Week’s Market Outlook:

- This week, the key focus is on the release of Consumer Price Index (CPI) on Wednesday, Producer Price Index (PPI) data and initial jobless claims on Thursday. The market's attention is firmly fixed on inflation data, with expectations that the year-on-year inflation rate will continue to moderate. Currently, there is little doubt about the 25 basis points interest rate hike scheduled for July 26th, and the focus will shift towards the interest rate trajectory after September.

- Earnings season officially begins this week. Banking stocks, including JPMorgan Chase (JPM), Wells Fargo (WFC), Citigroup (C), and BlackRock (BLK), are set to release their quarterly earnings reports. In addition, other notable companies such as UnitedHealth Group (UNH), PepsiCo (PEP), and Delta Air Lines (DAL) will also be reporting their important financial results.

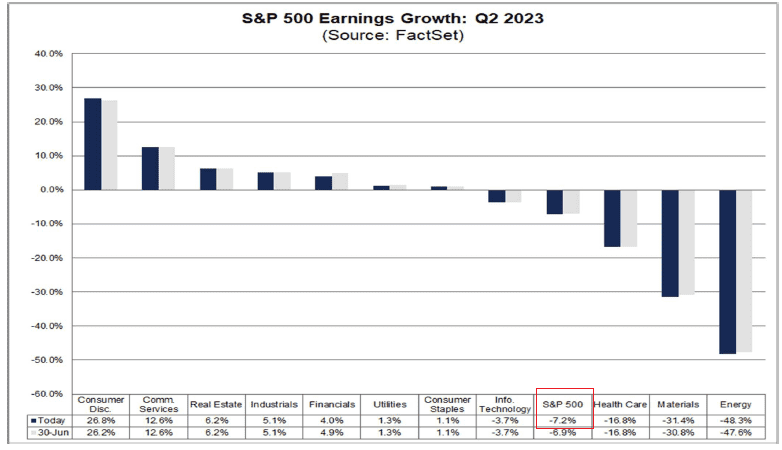

- S&P 500 faces moment of truth. According to FactSet (Figure 1), earnings are expected to decrease by 7.2% in Q2 compared to the same period last year. If this 7.2% year-on-year decline indeed materializes, it will mark the largest drop in earnings reported by the S&P 500 index since Q2 of 2020, which experienced a decline of 31.6%. Interestingly, the estimated earnings decline for the S&P 500 in Q2 2023 has increased to -7.2% from -6.9% during the past week. This increase lends support to our earlier argument that the expectations for corporate profits remain excessively high.

Figure 1: S&P 500 Earnings Growth: Q2 2023

Source: Factset, 7 Jul 2023

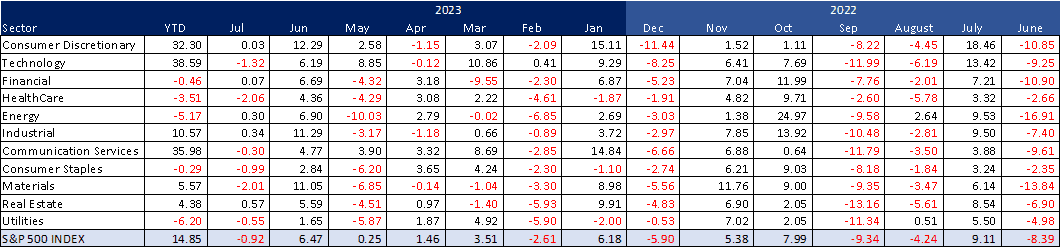

- S&P 500’s year-to-date return is 14.85% (Figure 2), but it has experienced a negative return of -0.92% in July thus far. The strong performance of the index has been primarily driven by technology-related stocks. The final week of July poses a significant test as major tech giants such as Microsoft, Google, Meta, and Intel are scheduled to announce their earnings during that period.

Figure 2: S&P 500 Sector Performance

Source: uSMART, Bloomberg, 10 Jul 2023

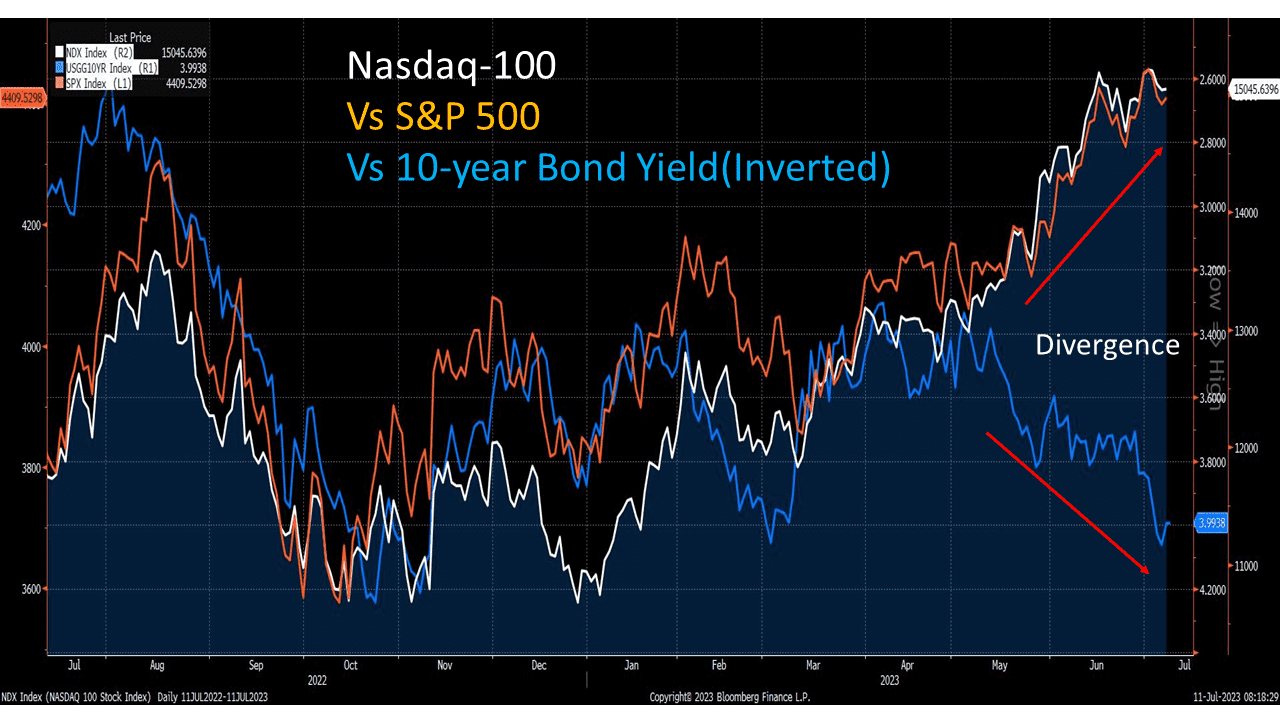

- The NASDAQ-100 and S&P 500 have maintained their outperformance this year, but they have diverged from the movement of the inverted US 10-year bond yield (Figure 3). Typically, higher yields will hurt equity valuations, leading to a decline in equity prices. However, investors remain optimistic about AI, resulting in a bullish market sentiment. Nevertheless, we anticipate a correction as we believe that the optimistic outlook for AI and earnings expectation has already been excessively priced in.

Figure 3: Nasdaq-100 Vs S&P 500 Vs 10-year Bond Yield

Source: Bloomberg, 11 Jul 2023

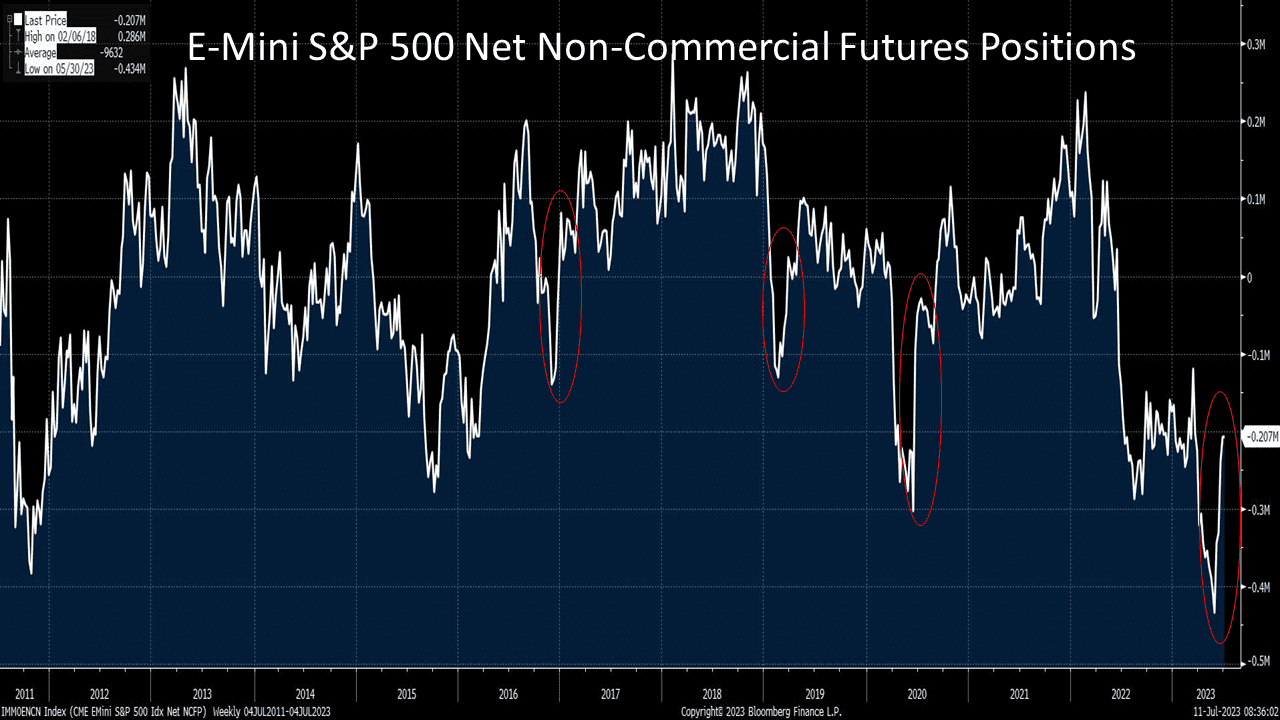

- Recently, the bears have been retreating, as evidenced by E-Mini S&P 500 Net Non-Commercial Futures Positions (Figure 4). It indicates a rapid unwinding of short positions in S&P 500 index futures. If the bears switch to bulls, it will provide upward momentum for the US stock market in the second half of the year.

Figure 4: E-Mini S&P 500 Net Non-Commercial Futures Positions

Source: Bloomberg, 11 Jul 2023

- The Nasdaq 100 has announced plans for a special rebalance in order to reduce the dominance of the 'Magnificent Seven' - Microsoft, Apple, Alphabet Inc., Nvidia Corp., Meta Platforms, Amazon.com Inc., and Tesla Inc. - which currently account for over half of the index's weight. According to the Nasdaq methodology paper, a rebalancing will be implemented to decrease the group's influence to 40%. The specific changes in weighting will be announced on Friday, July 14. The special rebalance of the Nasdaq 100 will be carried out before the market opens on Monday, July 24. The mentioned plan may trigger some selling of the mentioned stocks.

- I remain short term bearish as both the S&P 500 and Nasdaq-100 have recorded year-to-date gains primarily driven by PE expansion.

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimer:

This article is intended for general circulation and educational purpose only and does not take into account of the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment products mentioned. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product in question is suitable for you.

Past performance figures as well as any projection or forecast used in this article, are not necessarily indicative of future performance of any investment products. Your investment is subject to investment risk, including loss of income and capital invested. The value of the investment products and the income from them may fall or rise. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this article. Overseas investments carry additional financial, regulatory and legal risks, you should do the necessary checks and research on the investment beforehand.

The information contained in this article has been obtained from public sources which the uSMART Securities (Singapore) Pte Ltd (“uSMART”) has no reason to believe are unreliable and any research, analysis, forecast, projections, expectations and opinion (collectively “Analysis”) contained in this article are based on such information and are expressions of belief only. uSMART has not verified this information and no representation or warranty, express or implied, is made that such information or Analysis is accurate, complete or verified or should be relied upon as such. Any such information or Analysis contained in this presentation is subject to change, and uSMART, its directors, officers or employees shall not have any responsibility for omission from this article and to maintain the information or Analysis made available or to supply any corrections, updates or releases in connection therewith. uSMART, its directors, officers or employees be liable for any or damages which you may suffer or incur as a result of relying upon anything stated or omitted from this article.

Views, opinions, and/or any strategies described in this article may not be suitable for all investors. Assessments, projections, estimates, opinions, views and strategies are subject to change without notice. This article may contain optimistic statements regarding future events or performance of the market and investment products. You should make your own independent assessment of the relevance, accuracy, and adequacy of the information contained in this article. Any reference to or discussion of investment products in this article is purely for illustrative purposes only, is not intended to constitute legal, tax, or investment advice of any investment products, and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products mentioned. This article does not create any legally binding obligations on uSMART. uSMART, its directors, connected persons, officers or employees may from time to time have an interest in the investment products mentioned in this article.

Global

Global Singapore

Singapore Hongkong

Hongkong Group

Group