.jpg)

James Ooi/ uSMART Market Strategist

Over 13 years of experience in buy-side and sell-side of capital markets

Former Fund Manager of renowned asset management firm

Focus on fundamental analysis and macro-outlook for US & Singapore markets

SGX Academy trainer

This Week’s Market Outlook:

- Last week, the S&P 500 initially saw a midweek increase of 1.07%, but it ended the week with a 0.16% decline. This week marks the second consecutive week of losses.

- Last week, we witnessed a mix of economic data in the United States:

- August retail sales and initial jobless claims data performed better than expected.

- Inflation saw its largest monthly increase this year in August, with consumers facing higher prices for energy and various other items.

- The S&P 500 also closed lower on a day known as "triple witching," which involves the expiration of stock options, stock index futures, and stock index options.

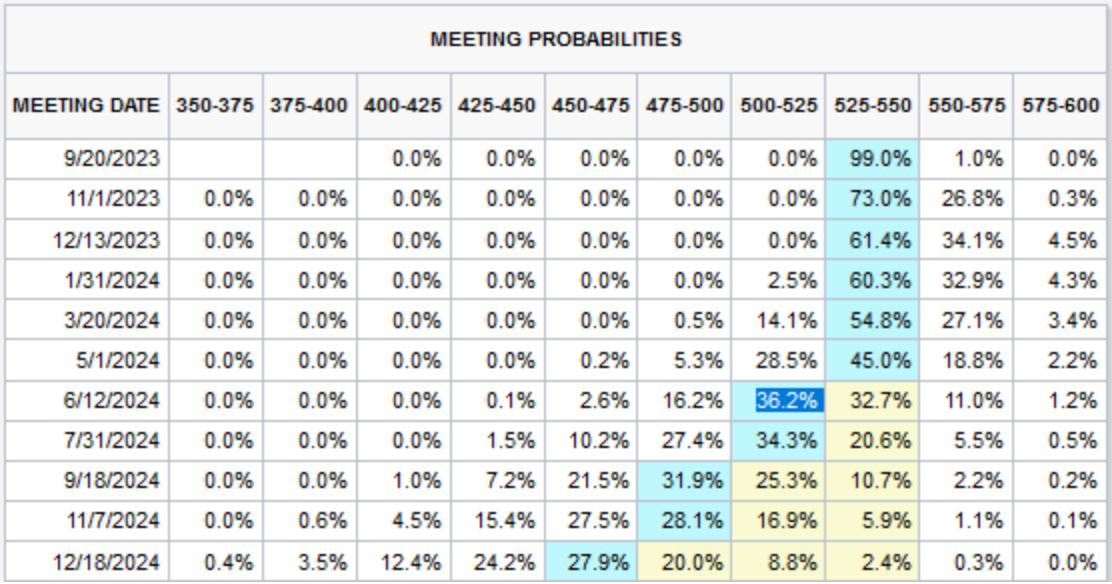

- This mixed economic data has led traders to anticipate that the Federal Reserve will keep interest rates unchanged at the September 20th FOMC meeting. Market participants are now projecting the first US rate cut to occur in June 2024 (Figure 1), in contrast to the earlier expectation of a rate cut in March 2024. This shift suggests that higher interest rates may hurt valuation multiples.

Figure 1: Meeting Probabilities

Source: CME Fedwatch, 18 Sep 2023

- The most noteworthy event of the week is the Federal Reserve's FOMC meeting on Thursday.

- This week, investors should be paying close attention to the possibility of index weakness, particularly due to concerns in the semiconductor and automotive sectors. A report suggests that TSMC is apprehensive about slowing demand and has instructed vendors to delay chip equipment deliveries. Furthermore, the United Auto Workers strike against the Detroit Three automakers entered its third day on Sunday with no immediate resolution in sight.

- The strengthening dollar indicates a potential crisis in the making, as strong dollar is eroding the overseas revenues of S&P 500’s companies. On March 8th, when the US dollar index closed at 105.6, the S&P 500 was trading at 3992. Currently, the US dollar index, now at 105.22, appears poised to surpass its March high, given the impending golden cross, where the 50-day simple moving average (SMA) is crossing above the 200-day SMA (Figure 2).

Figure 2: Rising Dollar

Source: Tradingview, 18 Sept 2023

- Apple's performance could continue to weigh down the S&P 500 and Nasdaq-100. Historically, September has been a challenging month for Apple, with an average drop of 1.95% over the past 25 years. In September 2023, Apple has already fallen by 6.85%, and in the month of September 2022, we witnessed a significant drop of 12.1% (Figure 3).

Figure 3: Monthly performance of the Apple over the past 25 years.

Source: uSMART, Bloomberg, 18 Sep 2023

【Follow us】:

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimer:

This article is intended for general circulation and educational purpose only and does not take into account of the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment products mentioned. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product in question is suitable for you.

Past performance figures as well as any projection or forecast used in this article, are not necessarily indicative of future performance of any investment products. Your investment is subject to investment risk, including loss of income and capital invested. The value of the investment products and the income from them may fall or rise. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this article. Overseas investments carry additional financial, regulatory and legal risks, you should do the necessary checks and research on the investment beforehand.

The information contained in this article has been obtained from public sources which the uSMART Securities (Singapore) Pte Ltd (“uSMART”) has no reason to believe are unreliable and any research, analysis, forecast, projections, expectations and opinion (collectively “Analysis”) contained in this article are based on such information and are expressions of belief only. uSMART has not verified this information and no representation or warranty, express or implied, is made that such information or Analysis is accurate, complete or verified or should be relied upon as such. Any such information or Analysis contained in this presentation is subject to change, and uSMART, its directors, officers or employees shall not have any responsibility for omission from this article and to maintain the information or Analysis made available or to supply any corrections, updates or releases in connection therewith. uSMART, its directors, officers or employees be liable for any or damages which you may suffer or incur as a result of relying upon anything stated or omitted from this article.

Views, opinions, and/or any strategies described in this article may not be suitable for all investors. Assessments, projections, estimates, opinions, views and strategies are subject to change without notice. This article may contain optimistic statements regarding future events or performance of the market and investment products. You should make your own independent assessment of the relevance, accuracy, and adequacy of the information contained in this article. Any reference to or discussion of investment products in this article is purely for illustrative purposes only, is not intended to constitute legal, tax, or investment advice of any investment products, and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products mentioned. This article does not create any legally binding obligations on uSMART. uSMART, its directors, connected persons, officers or employees may from time to time have an interest in the investment products mentioned in this article.

Global

Global Singapore

Singapore Hongkong

Hongkong Group

Group