Dear Investors,

As we bid farewell to the past year and embrace the opportunities of the Year of the Dragon, on behalf of the uSMART Securities Global Asset Allocation Team, I want to extend a heartfelt thank you to all our investors and partners for their unwavering support.

2023 was a rollercoaster ride in the financial markets. Despite challenges like record-high USD interest rates and geopolitical tensions in places like Ukraine and the Middle East, the overall impact on the US and global economies was better than expected. Favorable CPI and employment figures in the US painted a positive picture, driving significant gains in domestic blue-chip and tech stocks. On the flip side, economic recovery in Mainland China and Hong Kong fell short, with Hong Kong stocks feeling the pinch from outflows of Western funds and liquidity issues for property developers. However, emerging markets like Japan, India, and others brought some pleasant surprises. Looking ahead to 2024, we're hopeful for a USD/HKD rate cut and improved global economic conditions.

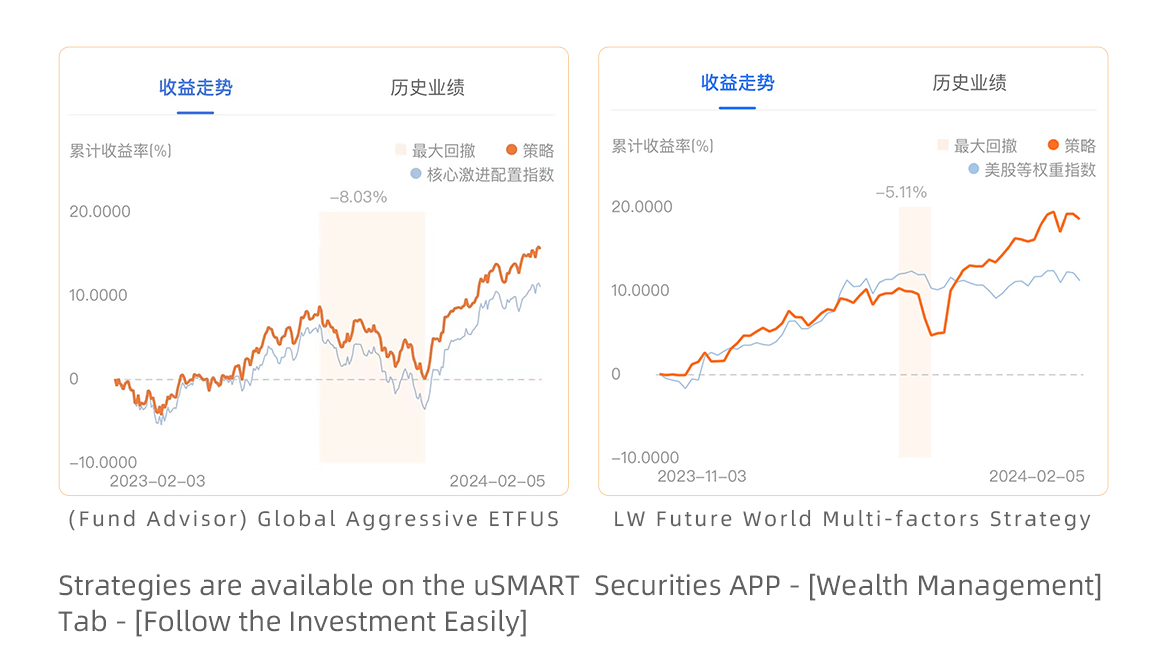

In response to the dynamic global market, the uSMART Securities Global Asset Allocation Team remains committed to providing clients with top-notch asset allocation solutions. Leveraging our expertise in asset allocation and product innovation, we ramped up our presence in India, Japan, and other emerging markets in Q4 2023. Among them, the Global Aggressive Allocation ETF Strategy Portfolio allocates to Xtrackers MSCI Japan Exchange Rate Hedged Equity ETF, U.S. Large Cap Growth ETF, iShares MSCI India ETF, Vanguard Emerging Markets Government Bond ETF, SPDR Gold ETF, Invesco Semiconductor ETF and other ETFs from different regions, sectors and themes around the world. ETFs from different regions, sectors and themes around the world, such as SPDR Gold ETF, Invesco Semiconductor ETF, etc. Our Global Aggressive Allocation ETF portfolio delivered an annualized return of 15.51%, outperforming the benchmark(Core Aggressive Allocation Index) by 2 percentage points.

To offer even more diverse and high-quality capital management services, uSMART partnered with reputable external institutions to introduce strategy portfolios on our platform. Our collaboration with Lida Wealth Management Consulting Limited brought the US Stock LW Future World Quantitative Strategy, delivering over 18.51% returns in the past three months, beating the S&P 500 Index. Moving forward, uSMART will continue to seek out exceptional asset management partners to enhance our offerings.

Looking ahead to 2024, the uSMART Global Asset Allocation Team remains focused on forward-thinking, value-driven strategies. We're excited about opportunities in the US stock market, driven by anticipated USD interest rate cuts and global tech innovation. With the US presidential election on the horizon, we anticipate market reactions to potential outcomes. Emerging markets could benefit from US-China trade decoupling, presenting unique investment opportunities.

In Hong Kong, while the market has seen low levels, there's potential for upside, especially in undervalued high-quality stocks. The implementation of the Hong Kong Investment Immigration Program could inject new life into the market. Japanese stocks continue to show promise, supported by structural improvements and rising household incomes. Emerging markets like India, Vietnam, Mexico, and Argentina are expected to outpace global growth rates.

In conclusion, investing is both an art and a science, and we're committed to delivering professional-grade asset management services. In the new year, our teams in Hong Kong and Singapore stand ready to assist investors with global asset allocation.

Warm regards,

uSMART Securities Global Asset Allocation Team

Global

Global Singapore

Singapore Hongkong

Hongkong Group

Group