Company Profile:

Microsoft is a multinational technology company originating from the United States, founded in 1975 by Bill Gates and Paul Allen. Headquartered in Redmond, Washington, USA, it is one of the five tech giants alongside Amazon, Apple, Google, and Meta. Its primary business includes research, development, manufacturing, licensing, and provision of a wide range of computer software services. Its most famous and best-selling products are the Microsoft Windows operating system and Microsoft Office productivity software. Other subsidiaries such as the Xbox gaming business are also well-known.

Product Areas:

Microsoft operates in various product areas, including:

- Operating Systems: Notably, Microsoft develops the widely-used Windows operating system for personal computers and Windows Server for enterprise servers.

- Office Software: Microsoft Office suite comprises popular applications like Word, Excel, PowerPoint, and Outlook for office productivity.

- Cloud Computing and Enterprise Solutions: Azure cloud platform offers a range of services for building, deploying, and managing applications, along with enterprise solutions like Microsoft 365 and Dynamics.

- Development Tools: Microsoft provides tools like Visual Studio IDE and .NET framework for application development.

- Gaming and Entertainment: Microsoft's Xbox brand includes gaming consoles like Xbox Series X/S and services like Xbox Live, along with the Windows Store for distributing applications and games.

Microsoft Corporation Stock Information, Annual Income Statement, Balance Sheet, and Cash Flow Situation (Reference Google Finance Data)

Ticker Symbol:: MSFT

Exchange:: Nasdaq

Market Capitalization: :$2,963,020,022,702 (as of January 19, 2024)

Index Inclusion: Dow Jones Industrial Average, S&P 500 Index, Russell 1000 Index, Russell 3000 Index, US Technology Index, Dow Jones US Index

Industry: :ASIC, PC Gaming, Artificial Intelligence, Enterprise Resource Planning, Streaming Media, Operating Systems, Customer Relationship Management, Wearable Devices, Audio Equipment and Parts, Suite Software, Software Industry, Cloud Technology, Search Engines, Gaming Consoles, Application Software

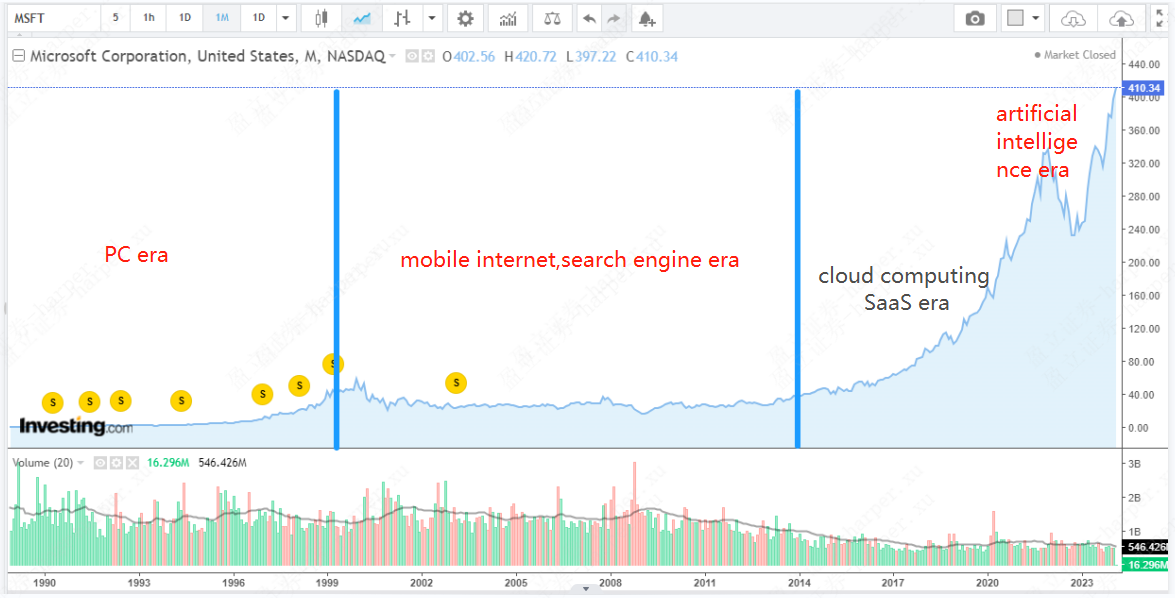

Microsoft Stock Price History

|

Events |

Time |

Stock Price |

|

Azure Cloud Platform Launches |

2010 |

30 |

|

Office 365 Launches |

2011 |

32 |

|

Launching Dynamics 365, Teams, and the $26.2 Billion Acquisition of LinkedIn |

2016 |

56 |

|

Openness, Joining the Linux Foundation, Office Mobile Transformation |

2017 |

85 |

|

The $7.5 Billion Acquisition of the Largest Open Source Community, GitHub |

2018 |

111 |

|

The $68.7 Billion Acquisition of Activision Blizzard |

2021 |

284 |

|

Investing in OpenAI |

2022 |

256 |

|

AI Empowering All Products |

2023 |

339 |

|

In-house AI Chip MMala |

2023 |

341 |

Key Barriers:

- Windows OS Dominance: Microsoft's Windows OS is widely used globally, creating a strong market monopoly in desktop operating systems.

- Office Suite Dominance: Microsoft's Office suite, including Word, Excel, and PowerPoint, is the standard office software for many businesses and individuals, making it challenging for competitors to enter this market.

- Developer Ecosystem: Microsoft's vast ecosystem, including the .NET framework and Azure cloud platform, attracts a large developer base, providing a competitive edge in software development and cloud computing.

- Patent Portfolio: Microsoft holds numerous patents across various fields, offering legal protection and enabling innovation in areas like operating systems, application software, and artificial intelligence.

- Enterprise Customer Base: Microsoft has a wide customer base in the enterprise market, with many organizations relying on its solutions like Windows Server and SharePoint, strengthening its position in this sector.

Microsoft's Industry Competitive Analysis:

1.Operating System:

Advantage: Dominance in desktop OS market with Windows, continuous innovation.

Disadvantage: Limited market share in mobile OS compared to iOS and Android.

2.Office Software:

Advantage: Office suite widely used globally, regular updates, integration with other tools.

Disadvantage: Competition from newer cloud-based office suites like G Suite and Slack.

3.Cloud Computing:

Advantage: Leading global provider with Azure platform, extensive services, integration with other products.

Disadvantage: Intense competition from AWS and Google Cloud.

4.Artificial Intelligence:

Advantage: Strong R&D resources, partnerships, diverse AI solutions.

Disadvantage: Competition from tech giants like Google, Facebook, and Amazon in the AI field.

Investing in Microsoft with a value investing approach makes sense due to several key factors:

1.Stable cash flow from core businesses like Windows, Office, and Azure.

2.Strong market positions across multiple sectors.

3.Continuous technological innovation and robust R&D capabilities.

4.Diversification across various business segments.

5.Sound financial management and consistent returns to shareholders.

Important Notice and Disclaimer

This document is prepared by uSMART. This document is not intended for or directed at persons under local laws or regulations that prohibit the distribution or publication of this document. This document is provided to the recipient only, and the information, materials, or analytical tools contained herein are provided to the recipient for informational and reference purposes only. This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The recipient shall not modify, transmit, or copy this document and its contents to any other person without prior written permission from uSMART. uSMART believes that the sources of the information and views contained in this document are reliable but makes no guarantee as to the accuracy, truthfulness, reliability, validity, timeliness, or completeness of the content of this document.uSMART or any of its directors, employees, or agents shall not be liable for any direct or indirect loss incurred by any third party due to the use/reliance on the content contained in this document.

Investment involves risks. Before making investment decisions, the recipient should carefully read relevant offering documents to obtain further information, including risk factors. Past performance data does not imply similar future performance. Investments in the asset categories mentioned in this document may not be suitable for all recipients. This document does not consider the individual objectives, financial situation, or needs of any specific person who may access this document. Before engaging in any transactions, the recipient should take reasonable actions based on personal objectives and circumstances to ensure a clear understanding of the transaction and independently evaluate the suitability of the transaction, including assessing the potential risks and returns of the transaction, and if necessary, seek independent professional advice. The information and opinions contained in this document reflect the judgment of uSMART as of its publication date, and no further notice will be given in the event of changes.

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Global

Global Singapore

Singapore Hongkong

Hongkong Group

Group